TrustWell’s Quarterly Market Review: Q4 2019

January 1, 2020

Highlights of the SECURE Act

March 1, 2020By Chris Daunhauer

TrustWell’s clients who are subject to RMD rules are increasingly using qualified charitable distributions (QCDs) to make annual charitable gifts directly from their IRAs. QCDs are a well-known and long-used tax avoidance technique. They’re recognized and accepted by the tax code and by IRA account custodians.

We think QCDs are smart! And I shared some of the whys and hows of QCDs back in November of 2019.

This follow-up post explains how to account for a QCD on your IRS 1040 – something that’s not always clear to the clients who do them. Most professional tax preparers know about QCDs, but those tax preparers won’t know that you did one unless you tell them so and give them the amounts of your QCDs.

It’s important that you (or your tax preparer) document your QCD correctly so that those QCDs (the portion of your distribution that was sent to a charity) do not get included in your AGI and (subsequently) your taxable income.

Unfortunately, the official IRS Form 1099-R that you receive from your IRA account custodian early the next year does not differentiate between distribution dollars sent directly to charity (that should not be included in your AGI for the year) and distribution dollars you took for personal use (that must be included in your AGI for the year).

The IRS Form 1040, however, is fairly clear and plays well with QCDs.

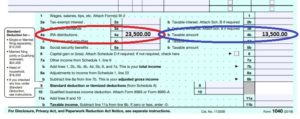

Here’s a simple example….. in 2019, Lisa Jones did a tax-free QCD from her IRA of $10,000 and she took an additional $13,500 as taxable income for personal use. Here’s how her 2019 distribution would be documented on her federal tax return…

The total amount distributed from her IRA (including any amount withheld and sent to the IRS against her eventual tax liability) was found in Box 1 of the 1099-R that she received from her IRA custodian (not shown here). For Lisa, that Box 1 amount was $23,500 and it gets copied over to Line 4a of the first page of her IRS Form 1040. But only the amount of that distribution that she received net of the QCD goes on Line 4b.

Here’s why…

The IRS uses Line 4a to confirm that Lisa met the RMD requirement for 2019. But it’s only the amount in Line 4b that has to be included in Lisa’s AGI for the year.

If Lisa had given ALL of her IRA distribution to charity via one or more QCDs, then Line 4a would show $23,500 and Line 4b would show $0.

For extra clarity, some filers (and some tax preparers) write in the letters “QCD” to the right of “taxable amount” on Line 4b.

Remember, the amount of your IRA distribution that was sent directly to charity via a QCD won’t be noted anywhere on your 1099-R. And your tax preparer won’t know about your QCD gifts if you don’t tell him or her about them. Without that information, your tax preparer will mistakenly assume that all of your distribution is subject to income taxes.

I’ve sent a formal suggestion to the IRS asking that QCD amounts be noted on future versions of the 1099-R form, but for now the forms don’t include them.

———–

Double dippers, beware! You should not include the amounts of your QCD gifts elsewhere in your tax return. Because QCD gifts have been kept out of your adjusted gross income, you cannot also claim those same gifts as itemized charitable deductions on Schedule A. If your favorite charity sends you a donation receipt that includes your QCD gifts on it (some charities will do this by mistake) you should ignore the QCD amounts on those receipts and not claim them anywhere on your return.

TrustWell has helped many of our clients reduce their taxes. QCDs are one way to do this. Please let us or your tax professional know if you’d like to learn more about them and other types of tax-smart charitable giving. We are happy to explain further and answer any questions you have.