Quarterly Market Review: October 2024

October 1, 2024

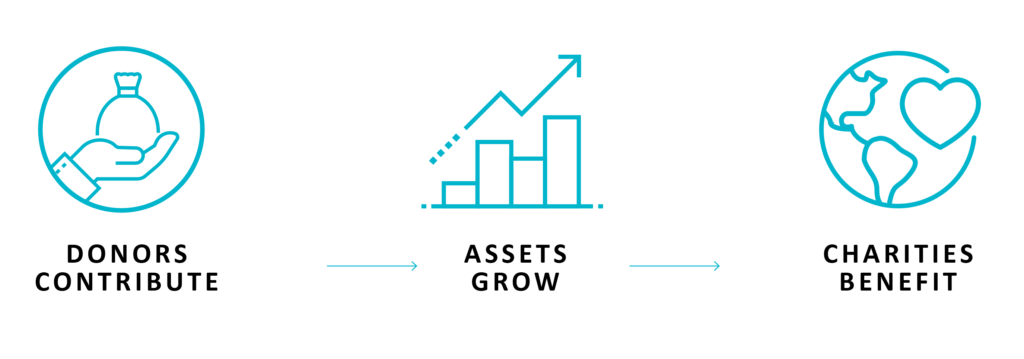

The Power of a Donor Advised Fund

December 1, 2024By Tanner Doudna

The IRS announced today the new, higher contribution limits for 2025. A great new rule for savers is being implemented back from late 2022 when the SECURE Act 2.0 was passed. People who will be ages 60, 61, 62, or 63 at the end of 2025 have an extra amount they can put into their 401k/403b/457. See below for a some of the higher limits.

- 401k/403b/457 is $23,500 per person (plus $7,500 for those age 50 or older)

- For those born in 1962-1965: On top of the $23,500 per person maximum, you can contribute another $11,250, bringing your limit up to $34,750.

- IRA/Roth remains at $7,000 per person (plus $1,000 for those age 50 or older)

- HSA is $4,300 for self-only coverage, $8,550 for family coverage (plus $1,000 for those age 55 or older)

- Solo 401k total contribution limit is $70,000 (plus $7,500 for those age 50 or older)

Investing is about time in the market, not timing the market and you can read more about the power of compoud interest here. We are here to help you reach your goals and determine the best way to get your money to work for you!