Understanding How Dividends Work

November 1, 2023

Quarterly Market Review: January 2024

January 2, 2024By Tanner Doudna

The IRS recently announced the new, higher contribution limits for 2024. While reviewing some of the changes, I thought it would be wise to share a reminder of the power of compound interest.

Compound interest is defined as “interest paid on both the principal and on accrued interest”. Albert Einstein called compound interest the “eighth wonder of the world” and Warren Buffett calls it “an investor’s best friend”.

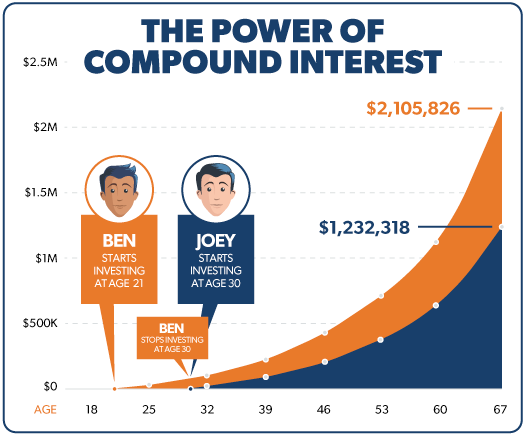

Compound interest is a great way for busy (and not-so busy) people to delineate growing wealth. While you’re out living your life, your savings is making more savings, and so on and so on. You are putting your money to work for you. And the sooner you start, the less work you have to do in the long run. Ramsey Solutions has a great visual on how beneficial it can be to start early.

Take two different investors growing their money at 11%/yr: Ben saves $2,400/year from ages 21 until age 30 for a total of $21,600 contributed. Joey starts at age 30, saving $2,400/year until age 67 for a total of $88,800 contributed. At age 67 Ben has almost $900,000 more than Joey!

The sooner you start the better! Below are some highlights of the new contribution limits starting in 2024:

- 401k/403b/457 is $23,000 per person (plus $7,500 for those age 50 or older)

- IRA/Roth is $7,000 per person (plus $1,000 for those age 50 or older)

- SIMPLE IRA is $16,000 per person (plus $3,500 for those age 50 or older)

- HSA is $4,150 for single, $8,300 for family (plus $1,000 for those age 55 or older)

- Solo 401k total contribution limit is $69,000 (plus $7,500 for those age 50 or older)

We are here to help you reach your goals and determine the best way to get your money to work for you!