2025 Contribution Limits, With New SECURE Act Limits

November 1, 2024

Quarterly Market Review: January 2025

January 1, 2025By Tanner Doudna

As the end of the calendar year approaches, charitable giving is often top of mind. During this time, hearts soften towards giving and we get to see the joy that can come from generosity. Another silver lining that can come from charitable giving is tax savings.

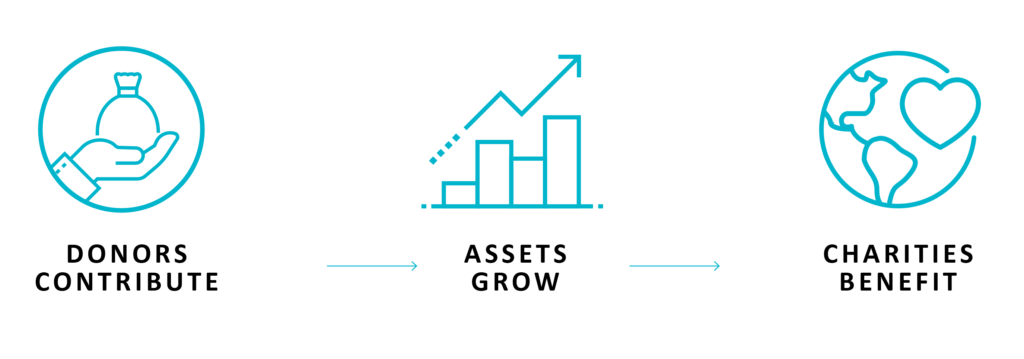

A Donor Advised Fund is a powerful vehicle that can maximize both your charitable giving and your tax savings. A Donor Advised Fund (DAF) is basically an investment account that is designated for charity. Different institutions have different names for a DAF, but they all work about the same.

Contributions

There are many ways to contribute to a DAF (which I’ll get to shortly), but once the money is in the DAF, withdrawals can only go to qualified charities (not back to you). The moment you contribute to your DAF is when you get your charitable donation, not when the money leaves the account. This can come in handy if you are doing tax bunching. You can contribute straight from your bank, or more powerful options like…

Appreciated Assets

There are a wide variety of asset-types that can be contributed to a DAF like privately held business interests, cryptocurrency, and others. The most common DAF contribution we help our clients with is gifting appreciated securities (like stocks, ETFs, etc.). You could sell your appreciated investment and donate the proceeds to your DAF, but you will still owe taxes on the growth. The alternative would be to transfer the investment directly into your DAF, completely avoiding any taxes on the growth.

For example: Let’s say Michael and Holly, a high-income earning couple, bought Dunder Mifflin stock for $10,000 a few years ago and now it’s worth $110,000. They could sell the stock and transfer the $110,000 of proceeds to their DAF (or directly to their favorite charity), but come tax time they’ll owe about $15,000 of tax on the $100,000 gain. They’ll still get the $110,000 charitable donation write off, but they owe the IRS $15,000 as a result of the sale. Alternatively, they could transfer the stock directly into their DAF. They get the $110,000 charitable donation write off, the charity gets a $110,000 donation, but they pay zero dollars on the gains of Dunder Mifflin stock.

While the Money is in the Account

Since you control the timing of when the funds leave the DAF, you have time to be diligent about which charities to support. While you are deciding, the funds in your DAF can often be invested. With options ranging from money market to equity investments, the account can frequently grow. While you don’t personally benefit from this growth, your future charitable recipients will get more money because your DAF is bigger! There can sometimes be administrative fees associated with a DAF that are usually based on a percentage of the account value.

Dispersing Funds to Charity

As I mentioned above, withdrawals can only go to qualified charities. Take as much time as you’d like, but when you are ready, you will recommend a grant to the Donor Advised Fund (DAF). Once approved by the institution who holds your account, the funds will be sent to your desired charity. An appealing option with DAFs is that you have the option to make your donation anonymous.

Donor Advised Funds (DAF) can be a powerful tool for your financial plan and they can be very easy to use. Please let us know if you have any questions about a DAF and we hope you will consider using one if you aren’t already!