Transfer on Death Deeds to Real Estate

May 1, 2022

TrustWell’s Quarterly Market Review: Q2 2022

July 1, 2022By Tanner Doudna

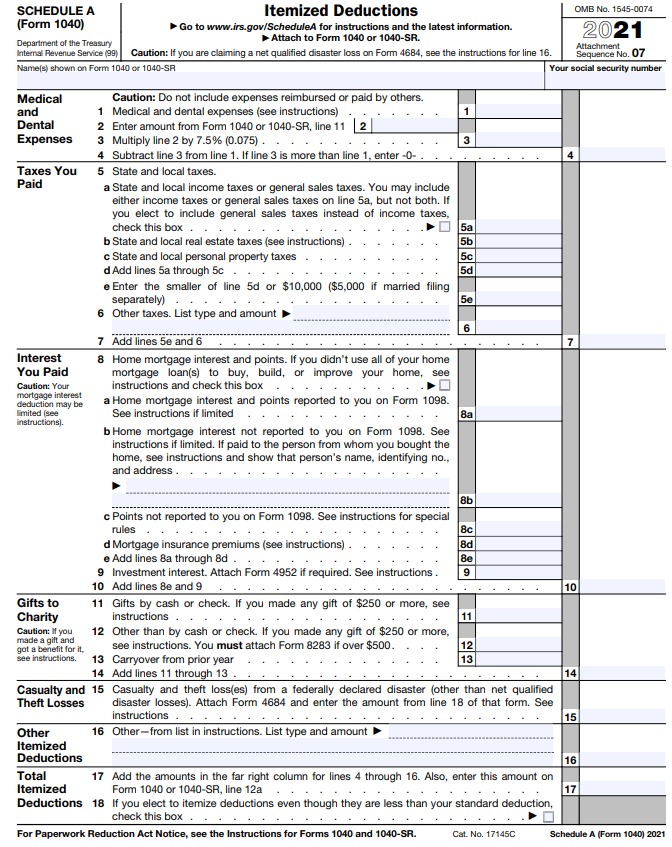

In 2017, the standard deduction was significantly increased in an effort to simplify taxes. With the standard deduction being as high as it is now ($25,900 in 2022 for married filing joint under 65), most people do not have enough deductions to make itemizing worthwhile, or they have just enough to where it’s almost a break-even. People are then losing out on significant tax benefits from the most popular deductions (charitable giving, SALT deductions, and mortgage interest). This dilemma is why many taxpayers have started what is called “Tax Bunching”.

Tax Bunching is when you “bunch” together your deductions into one tax year and itemize, then take the standard deduction the next. Below are some examples you can find on Schedule A of your tax return.

The Situation

Let’s look at an example: Mr. & Mrs. Lawrence make $150,000 per year in combined income. Let’s assume that their health expenses are not high enough to use as a deduction. Their property taxes are $5,000/yr. They give away $15,000/yr to charity, and they pay mortgage interest on their primary home of $6,000/yr.

Adding together their current deductions, they end up with $100 in deductions above the standard deduction ($26,000 vs. $25,900) – which means by itemizing, they saved only $22 more in taxes than they would have if say… they had only given $1 dollar to charity. The Lawrence’s are a perfect candidate for tax bunching. For them, I would recommend they bunch their deductions into odd years (2023, 2025, 2027, etc.) and take the standard deduction in even years (2024, 2026, 2028, etc.).

Property Taxes

Their first step happens in November 2022 when their bill for 2023 property taxes comes out. Although they get a discount for paying early, they should wait until January 2023 to make the payment. Then, when the bill for 2024 property taxes comes out in November of 2023, they should immediately make the property tax payment. They have bunched two property tax payments into one tax year (2023) which gets them a $10,000 deduction.

Giving

This area takes much more thought and planning. For all of 2023, they should give as they normally would. Before 2023 ends, they need to make a decision about their 2024 giving. If they are planning to give $15,000 again, they should either go ahead and make that donation(s) before 12/31/23, or they can give to a Donor Advised Fund (DAF) in their own name. Once they make the $15,000 contribution to their DAF, it all counts as a donation in 2023. BUT, they are then able to give to charities from their DAF throughout 2024 as they see fit. As a result of their proactive giving plan, they now have a $30,000 charitable donation in 2023.

Mortgage Interest

Unfortunately (or fortunately for other reasons), you cannot prepay a years’ worth of mortgage interest. You may be able to squeeze one extra payment into a tax year (13 for odd year, 11 for even), but you are essentially stuck with the results of your mortgage interest — $6,000/yr deduction for the Lawrence’s.

Results

By bunching their deductions into 2023, the Lawrence’s will have a $46,000 deduction (30 + 10 + 6) by itemizing in 2023. Then in 2024, they will only have $6,000 in deductions and will take the standard deduction ($25,900). With their income firmly in the 22% bracket, their 2023 & 2024 combined tax savings is almost $16,000 by bundling ($71,900 x 22%), and would have only been about $11,500 ($52,000 x 22%) if they keep up their current strategy. A true savings of $4,500.

—

There are some people who wouldn’t benefit from tax bundling, but for those who would – your TrustWell Financial Advisor would be happy to talk to you more about how to save some money on your taxes.