TrustWell’s Quarterly Market Review: Q1 2019

April 1, 2019

Truths About Social Security

June 1, 2019By Chris Daunhauer

TrustWell’s clients know that we think giving to worthwhile charities is one of the best things they can do with their money and appreciated assets. We’re not CPAs or tax preparers, but we often get to celebrate the giving our clients do to charities that matter to them.

I serve a retired insurance executive from St. Augustine who has had a long-time interest in funding a college scholarship in honor of his mother. Over the last six or eight years, with my guidance and encouragement, that client has gifted most of his annual required minimum distributions directly to a charity that has used his money to establish an annual scholarship for nursing students at UNF. In early April, UNF hosted a scholarship luncheon for donors and recipients and the client invited me as his guest to meet the recipient of this year’s scholarship.

Most of the money that this client gave over recent years to fund the scholarship was given in the form of a qualified charitable distribution (QCD) made directly from his IRA. Getting a tax deduction was never his primary goal, of course, but using a QCD allowed him to fund the scholarship and honor of his mother, satisfy the RMD rules, and at the same time reduce his federal income taxes.

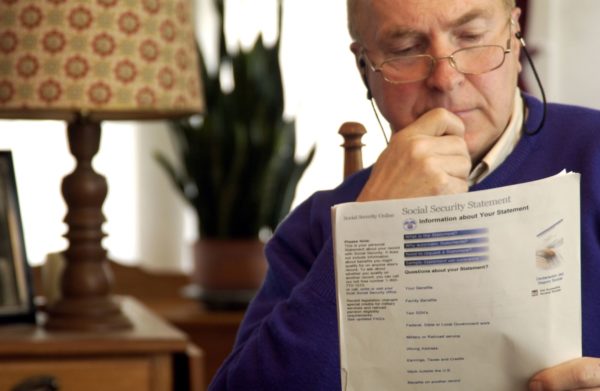

If you’re charitably minded AND you’re 70 ½ and have to take required minimum distributions (RMDs) anyway, then the advantages of a QCD might make it a tax-smart choice for you, too.

Here’s what makes a QCD appealing…

With the recent changes in the tax code (specifically the dramatic increase in the standard deduction) many taxpayers have found that their charitable giving no longer reduces their federal income taxes. That’s because the sum of all their itemized deductions was no longer more than their standard deduction. Under the new tax code, they (wisely) took the standard deduction, and their charitable giving had no impact on what they paid in taxes.

But….if you’re a taxpayer who must take required minimum distributions every year (you’re an IRA account owner who is at least 70 ½), there’s a potential work-around. The tax code allows you to gift some or all of your annual distribution from your IRA directly to charities of your choice (up to $100k per year).

Done correctly, a qualified charitable distribution satisfies the IRS rules for RMDs. The amount of your QCD gets documented on your tax return, but it’s not included in your AGI or taxable income, so you pay no taxes on the portion of your RMD that you gave to charity. In some cases it can reduce taxes due on Social Security benefits. And…. best of all…. you can also claim the full standard deduction elsewhere on your return. A QCD helps keep your charitable giving fully deductible regardless of how high the standard deduction is.

QCDs offer surprising flexibility — you can split your RMD into multiple parts – some to yourself as taxable income for your own needs, and some directly to your favorite charities through a QCD. You can also give to multiple charities in a single year, and (if you prefer) you can make your QCD gifts to charity anonymously.

TrustWell has helped many clients do QCDs over the years. Let us know if you’d like to learn more about them and other forms of charitable giving. We are happy to explain further and answer any questions you have.